cryptocurrency tax calculator us

Take the initial investment amount lets assume it is 1000. They compute the profits losses.

Bitcoin Tax Calculator Taxact Blog

The first one and the easiest and most reliable is connecting your exchange or wallet through an API key or public address.

. Crypto Tax Calculator. We offer full support in US UK Canada Australia and partial support for every other country. Crypto tax calculators work in several ways.

Read the input files and output files documentation. Divide the initial investment amount. The calculator is based on the.

Consider the below example on calculating your capital. Yesproceeds from cryptocurrency trades are taxed as capital gains. According to Shehan Chandrasekera from Forbes.

This means you can get your books. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Enter the sale date and sale price.

Buying goods and services with crypto. To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status. The federal short-term capital gains crypto tax rate ranges from 10-37 the same rates as income tax.

Enter the price for which you. Heres an example of how to calculate the cost basis of your cryptocurrency. Try It Yourself Today.

Long-term capital gains. Simply The 1 Tax Preparation Software. It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of.

February 12 2022 by haruinvest. The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and l ong term capital gains. CryptoTraderTax is the easiest and most intuitive crypto tax calculating software.

Filing your taxes is already complicated but it can be more confusing if you have bought or sold. What is a Crypto Tax Calculator. You simply import all your transaction history and export your report.

To calculate your capital gains when you sell cryptocurrency you can simply subtract the cost base from your capital proceeds. Ad Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms. To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or loss and compare your tax outcome of a short term versus long term.

Try It Yourself Today. An IRS 8949 cryptocurrency tax form must be filled out for every sale or transfer of mined cryptocurrency. Zen Ledgers Bitcoin Crypto Tax Calculator.

10 to 37 in 2022 depending on your federal. Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms. Depending on your tax bracket for ordinary income tax.

This means you can get your books. This means you can get your books. 0 15 or 20 tax depending on individual or combined marital.

Stop worrying about record keeping filing keeping up to date with the evolving crypto tax. Capital losses may entitle you to a reduction in your tax bill. Ad Well Help You Track Your Cryptocurrency Transactions And Report Them In The Right Forms.

How much tax you pay will depend on how long you hold your Bitcoin. Input and Output Files. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Simply The 1 Tax Preparation Software. For crypto assets held for longer than one year the capital gains tax is much lower. Enter the purchase date and purchase price.

You can check out our Free Cryptocurrency Tax Calculator which will answer all of your questions concerning cryptocurrency Bitcoin other alt-coin transactions and provide an. Essentially every time you achieve gains in crypto and realise those gains by cashing out youre creating a taxable event. Come and help us expand RP2s functionality.

You simply import all your transaction history and export your report. If you use Bitcoin to pay for any type of good or service this will be. RP2 is the first component.

This is a call for projects. You simply import all your transaction history and export your report. The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and l ong term capital gains.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets. Suppose John earned 020 BTC from mining on a day when.

The purchase date can be any time up to December 31st of the tax year selected. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. The calculator is based on the.

It allows you to calculate the profit and loss from cryptocurrency.

10 Best Crypto Tax Software In 2022 Top Selective Only

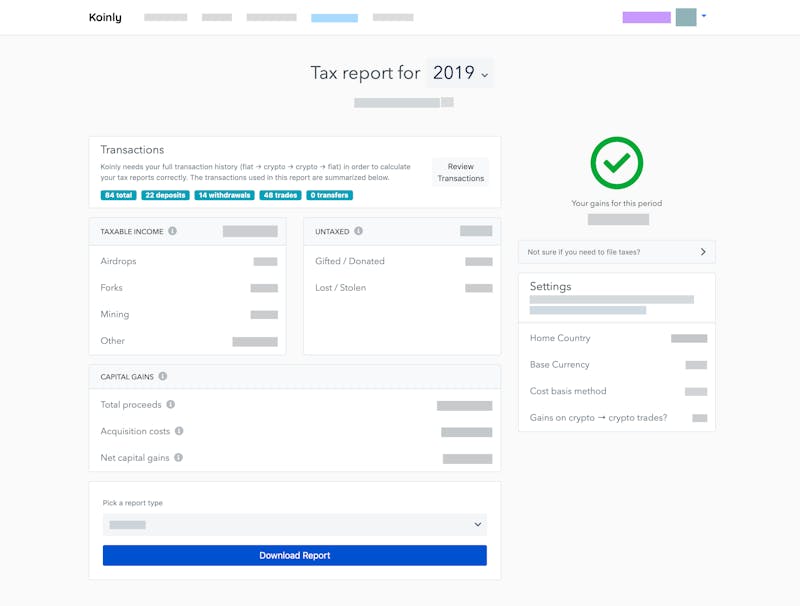

Irs Crypto Tax Forms 1040 8949 Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

How To Calculate Crypto Taxes Koinly

Cryptocurrency Tax Calculator 2022 Quick Easy

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

Cryptocurrency Taxes What To Know For 2021 Money

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Cryptocurrency Tax Calculator The Turbotax Blog

Calculate Your Crypto Taxes With Ease Koinly

Cryptocurrency Tax Calculator The Turbotax Blog

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Review Of 6 Crypto Tax Software Packages

Calculate Your Crypto Taxes With Ease Koinly

Understanding Crypto Taxes Coinbase

How To Do Your Binance Us Taxes Koinly

Calculate Your Crypto Taxes With Ease Koinly